is maine tax friendly to retirees

Heres a list of states that do NOT tax military retirement pay but do tax individual income. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all.

7 States That Do Not Tax Retirement Income

Is Maine tax-friendly for retirees.

. Not Tax Friendly States that offer minimal to no retirement income tax benefits. Social Security and public pensions are exempt from taxation but the Aloha State taxes private pensions and income from retirement saving plans at rates of up to 11. Individuals may deduct 10000 of pension income although social security benefits received reduce that amount.

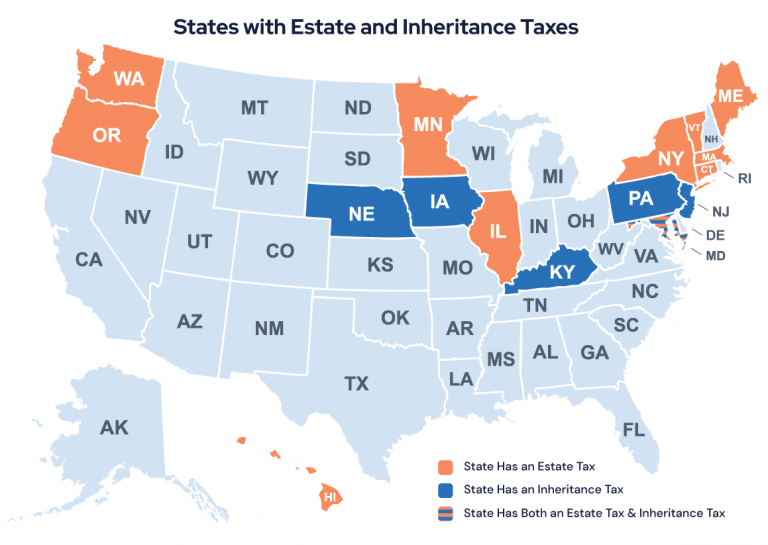

Property tax exemption for seniors 65 and older or surviving spouses 50 of first 200000 in actual value exempt No estate or inheritance tax. Social Security is exempt from taxation in Maine but other forms of retirement income are not. If you receive retirement income from a pension IRA or a 401k then you will be required to pay taxes as high as 715.

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Seniors who receive retirement income from a 401k ira or pension will pay tax rates as high as 715 though a small deduction is available.

Despite its nickname Taxachusetts. The state has the highest percentage of workers who are 65 years old or older. See our Tax Map for.

State tax on Social Security. The states that dont tax pension plans extend those same benefits to retirees with 401 k plans. Reduced by social security received.

If you file as part of a couple and earn a combined income of between 32000 and 44000 up to 50 percent of your benefits may be subject to taxation. States with no income tax seven states dont impose an income tax as of 2020. Is Maine Tax Friendly To Retirees.

Most residents pay 104 percent of the propertys market value. Alaska holds the top spot in WalletHubs taxpayer ranking and also has the most elder-friendly work market for retirees who might want to earn extra income. However Maines sales tax rate is considerably low at 55.

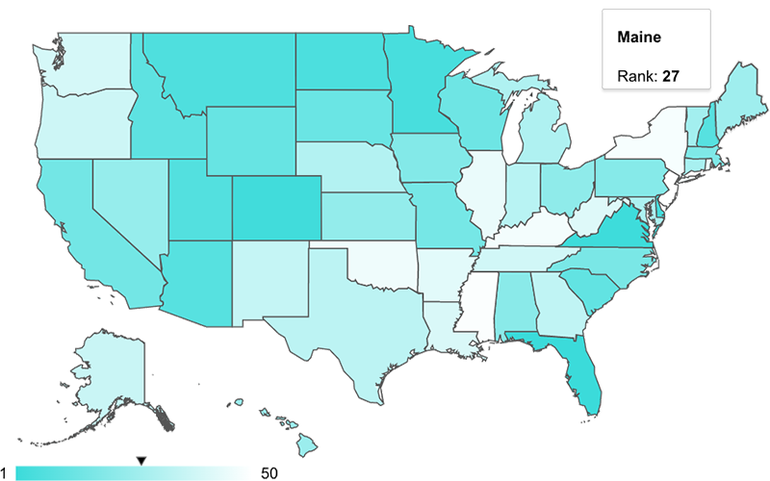

Social Security is exempt from taxation in Maine but other forms of retirement income are not. Income tax rates are also relatively low for most retirees and getting lower. How all 50 states rank for retirement friendliness.

Individuals may deduct 10000 of pension income although social security. Flat 463 income tax rate. State tax on social security.

Hawaiis top rate of estate. Maine Retirement Tax Friendliness Smartasset Is Maine tax-friendly for retirees. These states also do not have particularly friendly sales property estate and inheritance tax rates.

Maines income tax rate ranges from 58 to a top marginal rate of 715. 259 on up to 54615 of taxable income for married filers and up to 27808 for single filers 45 on taxable income over 500000. Luckily while you have to watch out for the Maine state income tax your.

Your 401 k withdrawals wont be taxed in Alaska Florida Illinois Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas Washington and. Income tax rate 65. Retirement income tax breaks start at age 55 and increase at age 65.

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Social security income is not taxed. State Income Tax Range.

Seniors who receive retirement income from a 401k IRA or pension will pay tax rates as high as 715 though a small deduction is available. For more news you can use to help guide your financial life visit our Insights page. The states property taxes are somewhat higher than the national average at a 130 effective rate.

Maine does not tax social security income. The states that dont tax pension plans extend those same benefits to retirees with 401 k plans. Average property tax 607 per 100000 of assessed value 2.

The states that dont tax pension plans extend those same benefits to retirees with 401 k plans. The remaining three Illinois Mississippi and. On the other hand if you earn more than 44000 up to 85 percent of your Social Security benefits may be taxed.

Seniors who receive retirement income from a 401k an ira or a pension will pay tax rates as high as 715. State sales and average local tax. Property taxes are also above average in Maine.

States With No Income Tax Eight states dont impose an. Click on any state in the map below for a detailed. Is maine a tax friendly state for retirees.

All residents over 65 are eligible for an income tax deduction of 15000 reduced by retirement income deduction. Deduct up to 10000 of pension and annuity income. You may also know that most VA.

Maine Retirement Taxes And Economic Factors To Consider

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Maine Retirement Tax Friendliness Smartasset

The Best States For An Early Retirement Health Insurance Life Insurance For Seniors Early Retirement

10 Least Tax Friendly States For Retirees Castle Hill Lighthouse Us Destinations Lonely Planet

A Guide To The Best And Worst States To Retire In

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

The Most Tax Friendly States For Retirees Teton National Park Jackson Hole Grand Tetons Grand Teton National

37 States That Don T Tax Social Security Benefits The Motley Fool

A Guide To The Best And Worst States To Retire In

Top Ten De Paises Ideales Para Vivir Retirement Planning Places To Go Travel Infographic

Hobby Income For Retirement Youtube Retirement Planning Personal Finance Advice Retirement Pension

Maine Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

Maine Retirement Tax Friendliness Smartasset

Map Here Are The Best And Worst U S States For Retirement In 2020

Maine Among Priciest States To Retire Study Says Mainebiz Biz